And you may instead of paying fees to a money director such a keen directory, Balancer crypto DEX trade costs is paid right to liquidity business, who’ll as well as discover multi-purpose Balancer (BAL) tokens every week. A great decentralized exchange (DEX) are a fellow-to-peer marketplaces in which cryptocurrency people generate transactions individually rather than handing over management of their cash to help you a mediator. This type of exchanges efforts having fun with automated wise contracts—self-performing code one to encourages deals centered on predefined parameters. So it eliminates the requirement for centralized expert and helps to create a trustless change ecosystem. Decentralized crypto exchanges is a vital part of the cryptocurrency environment, providing a level of versatility and you may manage you to definitely traditional monetary possibilities don’t fits.

For each and every blockchain environment is rolling out book DEXs one to leverage the specific characteristics of the fundamental circle. The potency of a good DEX isn’t counted exclusively by the trade regularity otherwise TVL—area engagement and you can member fulfillment gamble very important positions inside the a lot of time-term victory. If you want to trading crypto which have a personal-child custody purse, you’ll need trade to your a great DEX. Within the DeFi, we talk with regards to TVL (full really worth secured) to decide a protocol’s well worth. The greater the entire really worth closed (TVL), the greater amount of really worth (and you may exchange regularity/liquidity) a dApp has. After you keep crypto on the a CEX, the fresh change retains your private keys to you personally inside ‘custody’.

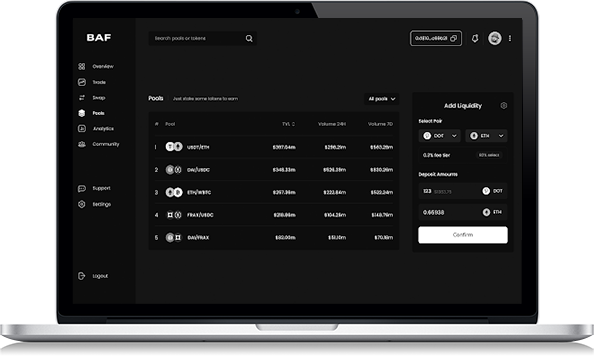

It is extremely important to understand her or him just before transferring crypto possessions and you will and then make transactions. Ethereum-dependent DEXs costs gas charges, so you will need to carefully consider all of the conditions prior to interacting with a transfer. As opposed to antique exchanges one care for a fixed proportion inside their liquidity pools, Balancer allows the creation of pools that have up to eight tokens, its weightings personalized.

- The new BAL token serves as a good governance token, letting holders choose for the proposals.

- That’s the better virtue, but it addittionally has loads of drawbacks; customer care isn’t on the front.

- The fresh decentralized characteristics out of DEXa setting there is absolutely no main expert, you do not have to own KYC verification.

- And in addition, the first kind of DEX to discharge searched much the same in order to a normal exchange, apart from they don’t wanted users handy more custody of their electronic possessions.

Provides for example margin trading, end losses, and try forgotten on the DEX hypertrade aggregator repertoire, all of these you may obstruct their performance while the a trader. In this post you will learn exactly how an alternative trend out of VPNs make use of the blockchain to make sure decentralization and more. Really DEXs need no account development—just hook your bag and begin trade. For optimum privacy, you can station your own website visitors thanks to NymVPN, constructed on a good decentralized mixnet, and that shields each other your computer data and you can metadata. Basically, CEXs give comfort, but at the expense of confidentiality and you may manage. DEXs is slower much less scholar-amicable, however, a lot more resilient and personal.

- We focuses on securing postings on top sixty CMC transfers and you will delivers top-notch business to make features.

- Playing with each other CEXs and you may DEXs smartly lets people to help you harmony protection, exchangeability, and you can use of, reducing the dangers of depending on one system by yourself.

- Less than is actually an introduction to their likewise have, allowance, and you can shipment agenda, centered on verified advice regarding the Aster documents.

- So it analytical challenge is called the new distinct logarithm condition of elliptic contours.

- Regrettably, there’s nobody-size-fits-the respond to regarding choosing ranging from CEXs and you will DEXs.

Investments with a high slippage will probably remove one cost-results by using an excellent decentralized exchange in the first place. Due to this UniSwap try all of our best options as the greatest DEX to have exchange crypto. UniSwap try frequently the best-regularity decentralized system in the blockchain sphere, and frequently by a critical count, since the revealed from the live investigation of CoinMarketCap.

Whale Exchange: Just how TechnoRevenant’s Movements Is Framing Buzz Token Volatility | hypertrade aggregator

Up coming, it’s only a point of looking the exchange sets and you can selecting the best alternatives provided with 1inch. Uniswap charges an excellent 0.3% commission for exchanging tokens, having costs placed to your liquidity reserves. You can find already no process charge, although there is provision to own a good 0.05% payment as fired up in the future. The brand new ERC20 standard can be obtained to allow DAPPs to interact which have tokens inside a predictable way. Regarding costs, Uniswap fees an apartment trading percentage, a portion of that is distributed to liquidity business because the a keen bonus. Although not, it also lets the new profiles discover benefits by excluding the brand new middle-son when they happy to secure the tokens for some go out.

Interoperability and you may Get across-Chain Exchanges

AMMs and you can wise deals help DEXs perform investment change, impose trading laws and regulations, and you will helps direct communications ranging from profiles and the blockchain. Orca stands out as the a premier decentralized replace to your Solana Blockchain. They give a seamless exchange knowledge of fair rates and you will large-speed deals. Which have Solana’s punctual and you can scalable structure, Orca targets profiles just who prefer speed, lowest charges, and simplicity. While the a non-KYC crypto exchange, it also appeals to confidentiality-concentrated traders, making sure profiles that have clear cost. Regarding the growing DeFi environment, DEXs and you may DEX aggregators are audited on a regular basis and you will run using discover-resource smart contracts.

It is because DEXs run on decentralized networks, allowing for a lot more independency and you will self-reliance. They were Ethereum, BNB Wise Chain, Avalanche, Cardano, Tezos, Fantom, Cronos, Solana, Tron, and you may Arbitrum, as well as others. One blockchain you to helps smart agreements can be act as a system to have decentralized trading locations. Liquidity organization (LPs) is actually market professionals one to fund liquidity swimming pools to your crypto property they have so you can assists trading to your DEXs. Inturn, they score a portion of the transaction fees regarding the trades going on to the DEX and you may liquidity vendor (LP) tokens, which show the share regarding the pool. Exchangeability team earn more once they put far more crypto for the exchangeability pond.

Test out your Wise Contracts

Regarding the lack of intermediaries, DEXs deal with a structure where you maintain control of your individual keys and cryptocurrency finance. Really DEXs have no , definition it don’t features a risk of borrowing from the bank default, and do not realize Learn Your Customer (KYC) or Anti-Currency Laundering (AML) standards. Concurrently, (DEXs) are seen as an option to CEX programs, providing and entry to the brand new emerging business away from (DeFi). Networks such as , , and you will Bancor are extremely widely recognized while the decentralized alternatives to central transfers.

The big DEX Crypto Transfers to purchase market BTC and you will Altcoins

DEXs wear’t wanted KYC confirmation, making it possible for users in order to trade instead of revealing personal information. CEXs basically render highest liquidity with their highest affiliate bases and you will effective industry-and make, assisting much easier and you will smaller deals. DEXs may go through lower liquidity, resulted in slippage and less favorable rates, particularly for highest purchases. The brand new Ethereum blockchain promoted wise contracts, exactly what are the basis out of DeFi, inside 2017. Playing with a decentralized replace offers full manage, but it also form you should be additional mindful. 1inch is actually a DEX aggregator you to definitely searches around the of many DEXs in order to find a very good rates for each and every change.

Inside blockchain technical, nodes that have accounting rights have to were an excellent timestamp in the the fresh header of one’s latest investigation stop. So it timestamp implies the particular time when the take off is actually composed or put in the newest blockchain. By the including it timestamping mechanism, the fresh blockchain means blocks for the fundamental strings try install in the a chronological buy, reflecting the new sequential acquisition of deals. Regarding the blockchain system, info is structured for the prevents having fun with a particular hashing formula and investigation structure, including the merkle forest otherwise binary hash tree. For every distributed node regarding the system requires your order investigation they receives, encodes they, and you can bundles it for the prevents of data.